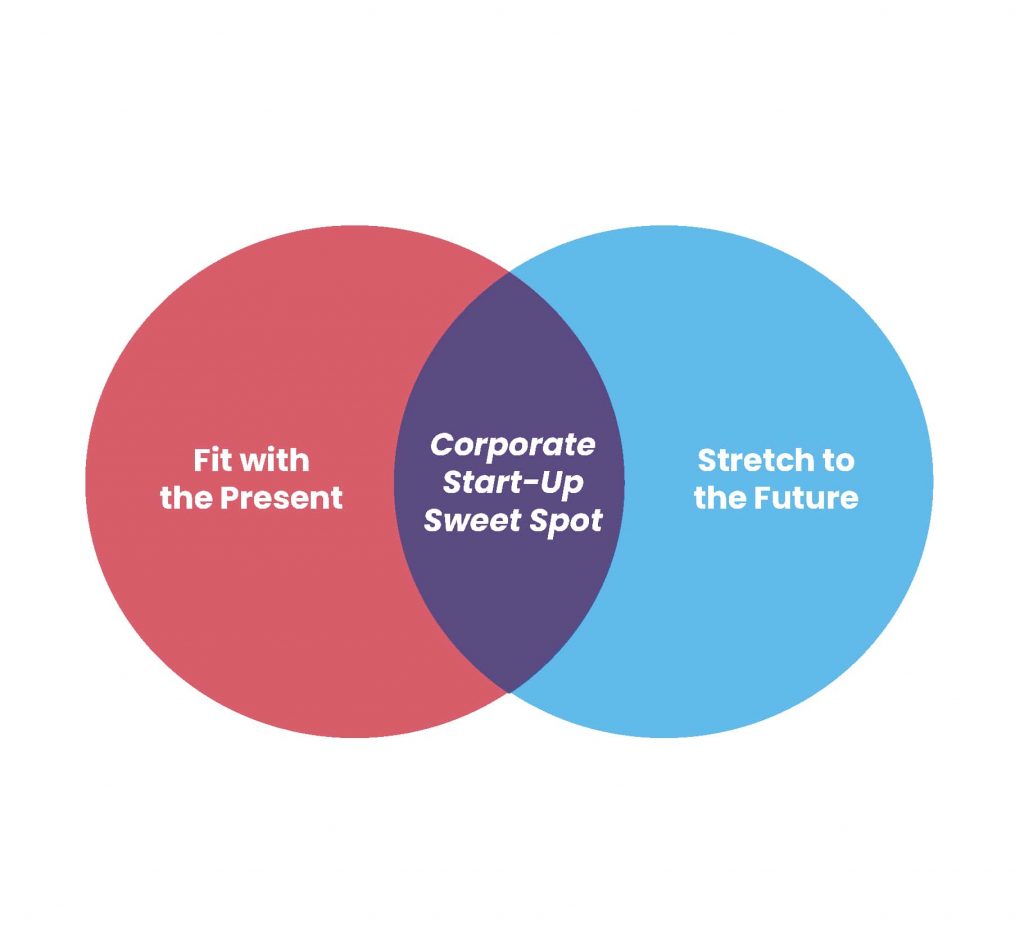

The corporate start-up sweet spot is where an internal venture provides corporate fit and stretch, in terms of markets, strategic learning, and business model.

The rationale for corporate start-ups is that large companies have a resource advantage over start-ups-in-the-wild, in the form of customers, brand, expertise and capital. In other words, they have the ability to generate corporate leverage to help ventures scale up.

Therefore, assuming corporate teams can identify pain like a startup, they should be able to build and scale ventures more effectively and efficiently than a greenfield competitor with the same idea.

However, in practice, generating corporate leverage is easier said than done. Internal ventures compete for attention and resources with established product lines. The key to unlocking leverage is getting the right strategic distance between the venture and the core business. Too far out, then the venture is irrelevant, and the levers don’t work. Too close in, then the venture is too similar, and more value can be created by applying the levers to the core.

The sweet spot is where a corporate start-up provides the parent with both fit and stretch at the same time, in terms of markets, strategic learning, and business model. As Frank Mattes describes in his new book, “The Lean Scaleup”, the difference between internal ventures and independent startups is contextuality: an internal venture must work in the corporate context as well as the customer context, for leverage to be possible. It has to be both ‘worth scaling’ and ‘ready to be scaled’.